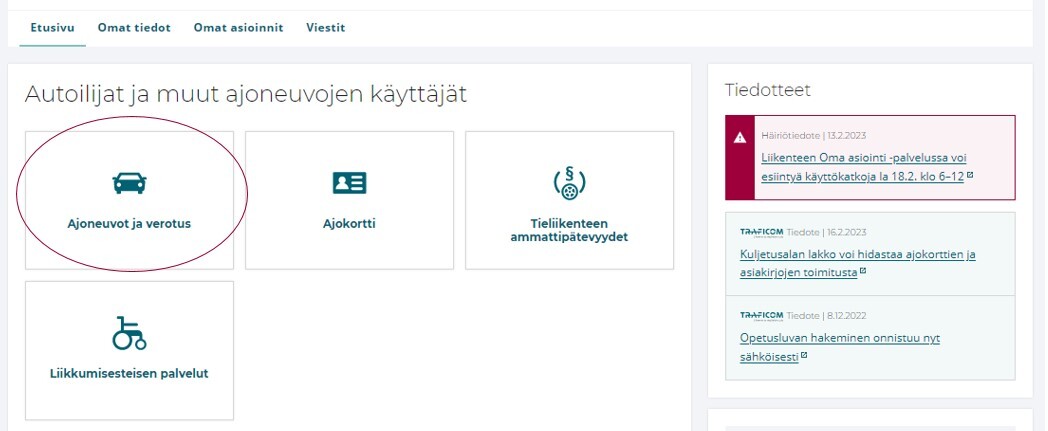

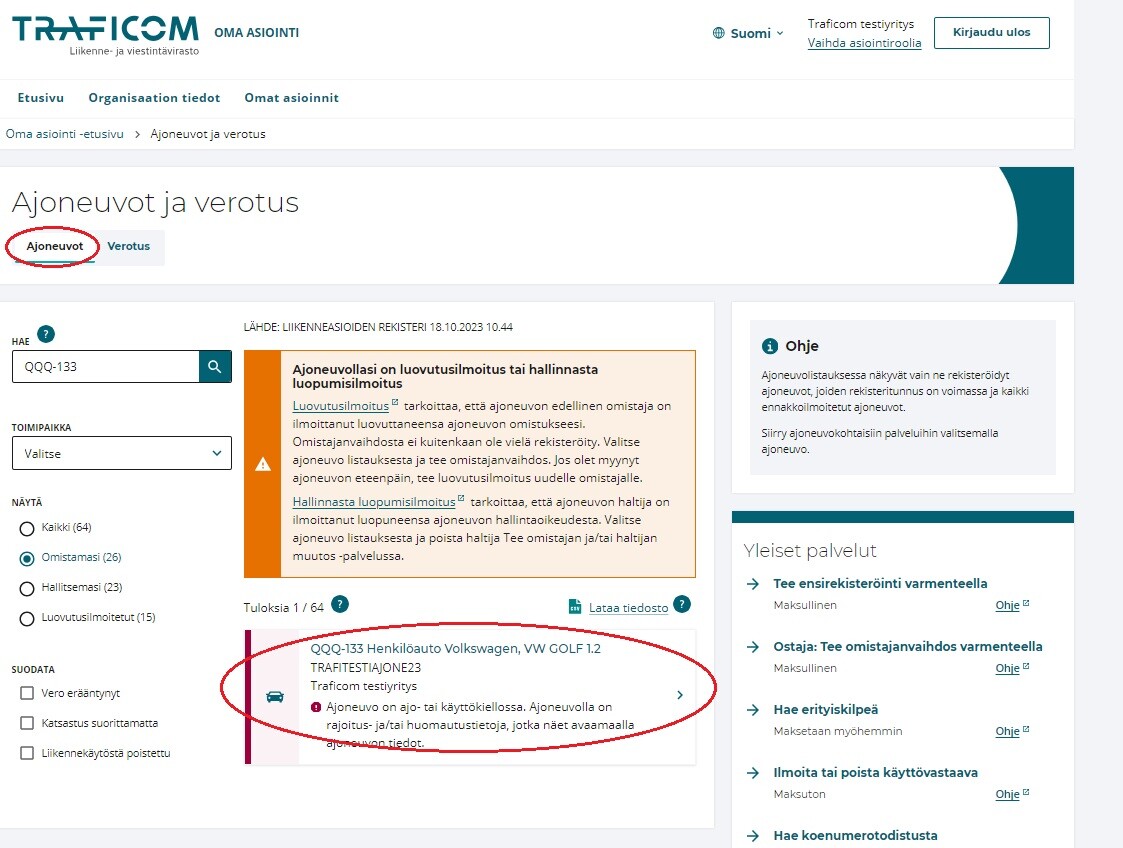

Log in to My e-Services

After authentication, choose your user role: personal services or acting on behalf of your company/organisation.

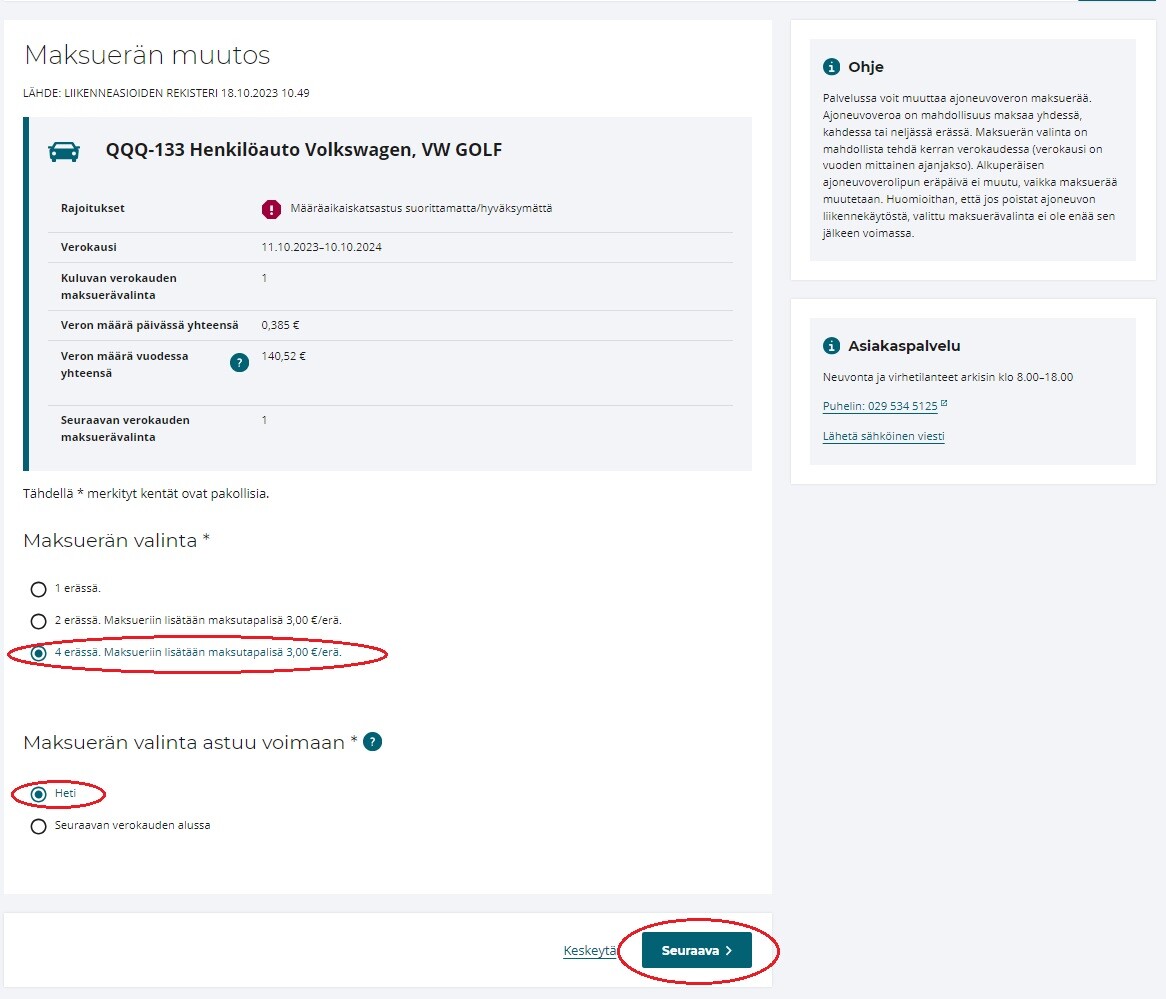

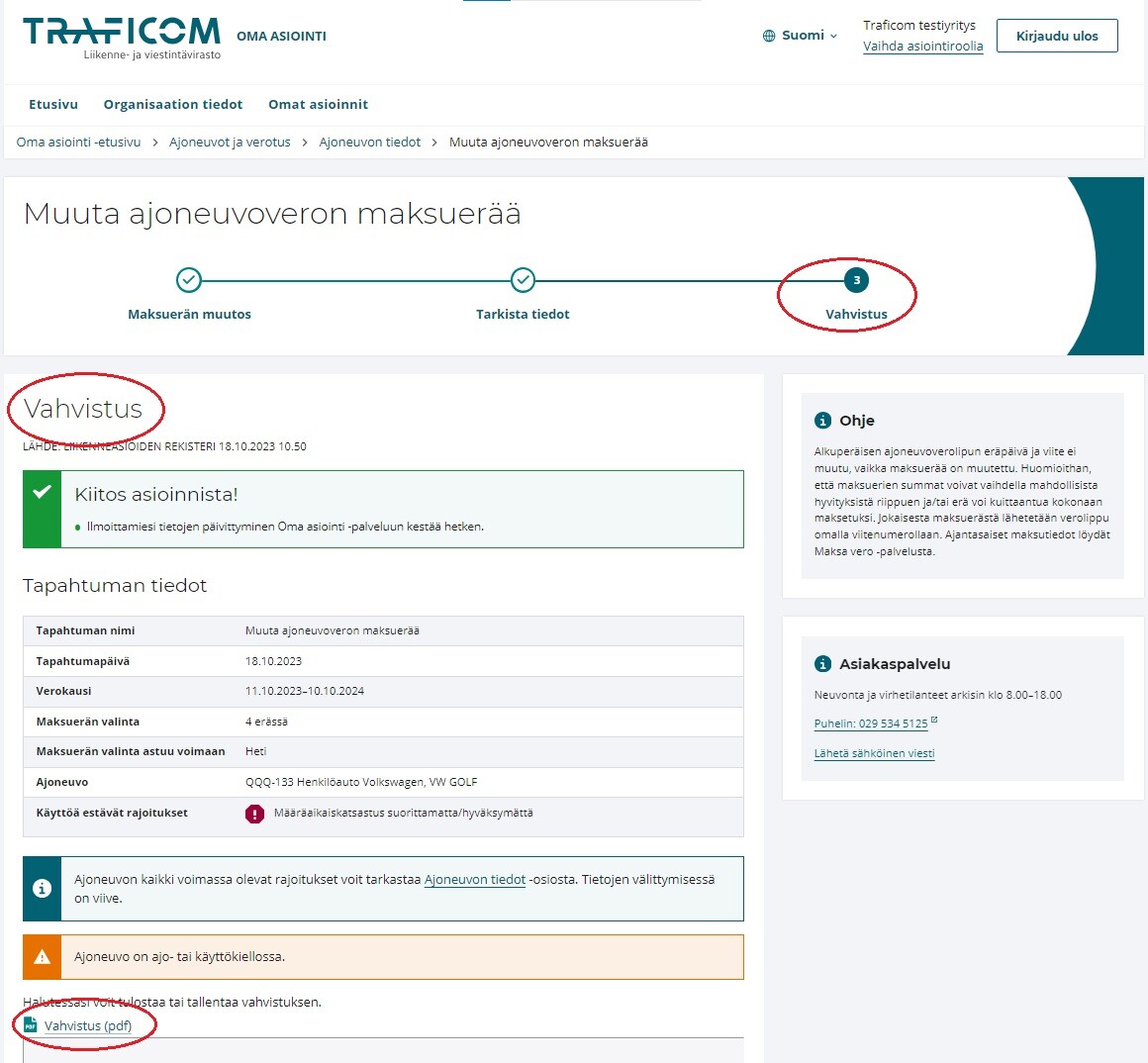

In addition to making a single payment, you can also pay your vehicle tax in two or four instalments. You can change the number of your instalments once in a tax period, and you must give notification of the change before the first due date of the new tax period. When you pay your vehicle tax in instalments, a charge of EUR 3 will be added to each instalment.

After authentication, choose your user role: personal services or acting on behalf of your company/organisation.

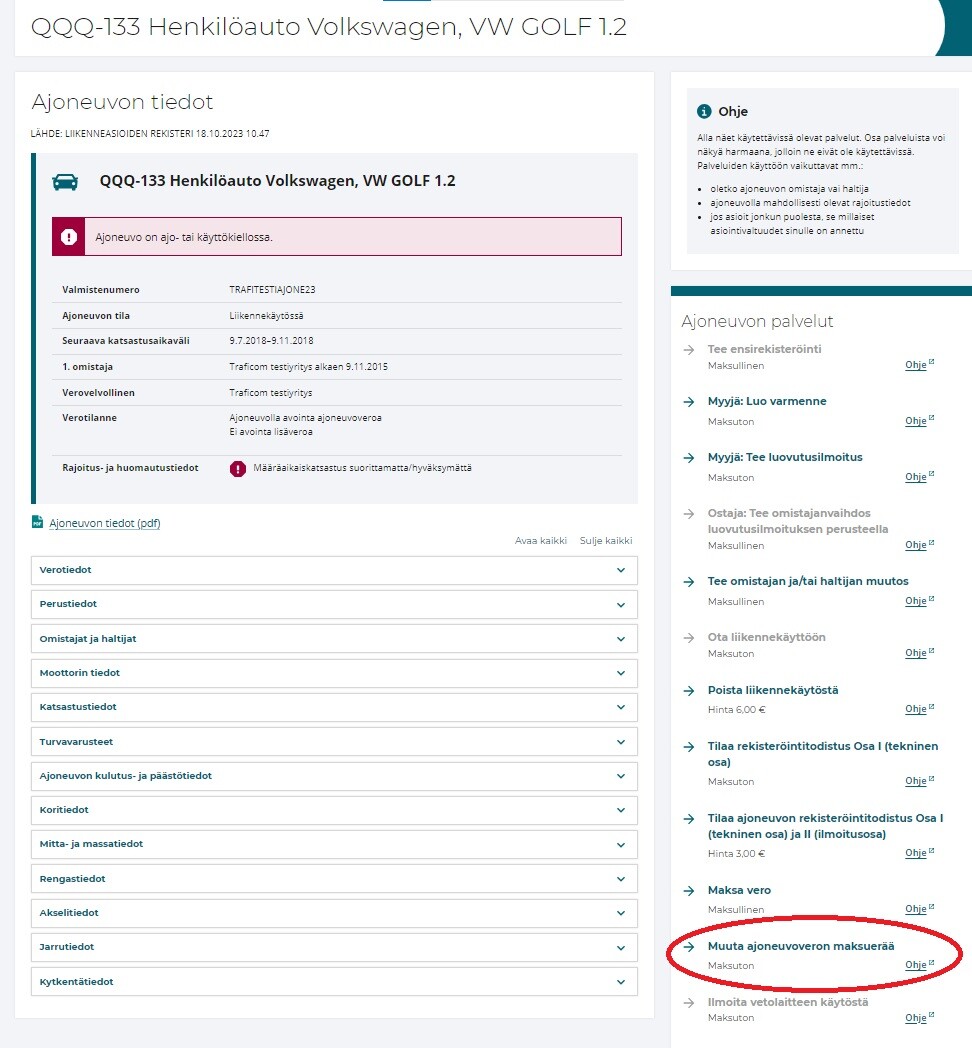

You can find your up-to-date tax information (External link) under “Taxation”, where you can pay outstanding taxes.